By Starfleet Research, with underwriting support from The Rainmaker Group - 4.19.2019

The processing power embedded in today’s smartphones and tablets makes it possible to perform analytic tasks in the palm of your hand that only a few years ago would have required a desktop computer and server. The fact that many of the most sophisticated and powerful enterprise applications are now available anytime, anywhere works to the great advantage of hotel operators who, given the nature of their jobs, are almost always on the go.

Not surprisingly, the new breed of hotel business intelligence tools are cloud-based, mobile-enabled and specifically designed to meet the needs of on-the-go hotel operators. The tools deliver deep insights, faster and in far more accessible ways than most people only a few years ago could have even imagined possible.

The tools can pull data from the property management system, central reservation system, point of sale system, CRM system, channel management system, and any other existing system. The tools can also extract data on-the-fly from spreadsheets and any number of other sources, including guest satisfaction survey repositories, call centers, social networking apps, and website, mobile and in-room chatbox and text-based device logs.

BI means using interactive visualization tools to bring data to life in a dazzling array of color-coded charts, funnels, pies, spider webs and various other configurations as well as drill-down and data filtering features to navigate, manipulate and analyze the data.

Still, it is important to remember that, initially and also on an ongoing basis, BI also means leveraging the right data. The value of the interactive visualizations, dashboards and reports is entirely contingent on the quality of the data from which they are generated.

The diversity, velocity and sheer volume of data in the hotel industry has increased by orders of magnitude in recent years. Hotel operators today have an embarrassment of riches when it comes to data. There is practically no end to the number of internal and external data sources at their disposal.

Meeting their business intelligence needs means, as a first step, connecting to data, whatever its source and wherever it may reside. But the key is to do so selectively, based on business objectives, whether those objectives relate to streamlining hotel operations, improving revenue management or identifying emerging trends in guest behaviors or market activity.

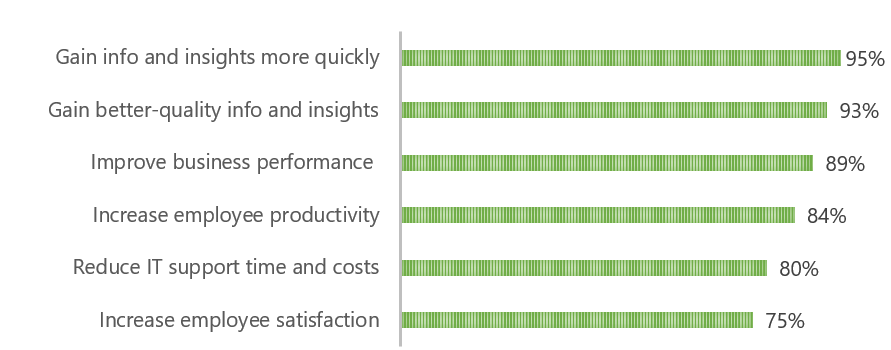

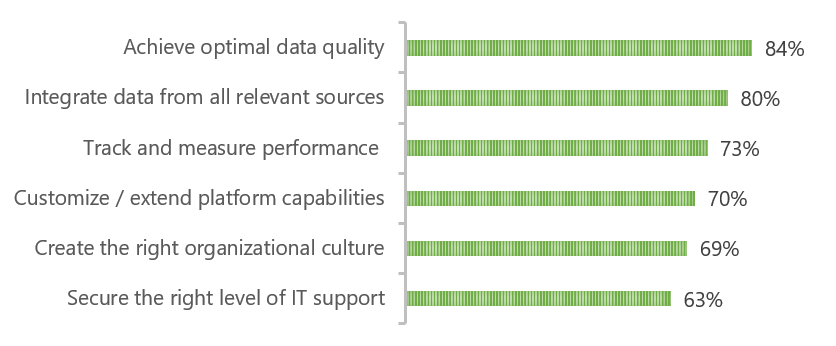

The question is: What data is relevant what data is not relevant and should not be included? This ranks as one of the top challenges with business intelligence, according to hotel operators, as indicated in the chart below.

In terms of data requirements for revenue management, most people would agree that the volume and depth of clean historical data related to occupancy, rate and revenue figures, including booking dates, rate codes, arrival dates, departure dates and revenue by day, provides the strongest basis for predictive modeling and forecasting accuracy.

For a large property, the totality of the data set may include dozens of guest segments, a dozen or more room types, several years of historical booking and reservations data, and upwards of a dozen length-of-stay buckets.

Multiple other data sources may also provide significant value. For example, web shopping data (the number of travelers looking at and booking rooms and at what price, as well as the percentage of visitors abandoning the hotel website) can provide insights into current and future room demand as well as price sensitivity.

Because travelers shop beyond hotel websites, there are insights to be gleaned from the travel distribution network, as well — although, according to research conducted for a recent Starfleet Research study in partnership with The Rainmaker Group, less than one-third (29 percent) of hotel operators are capturing and integrating data related to guest website search and shopping behavior.

While more hotel operators are integrating customer lifetime value data into pricing and availability, modeling consumer behavior from click-stream data, and integrating loyalty and total property spend data, only 62 percent of hotel operators indicate that they are currently using spend data to determine the value of guests by segment. That percentage is bound to increase over time.

Market-level data, including publicly available competitor rate information gleaned from multiple channels, may also rank as a must-have data source. Most hotel operators agree it is necessary to closely monitor competitive activity in order to avoid significantly underselling or overpricing guest room inventory.

For sales and marketing data requirements, length and purpose of stay data as well as the history of individual guests’ on-property behavior, such as their food, drink or spa treatment preferences, may be valuable in determining what offers should be sent to them and the messaging around those offers. How the recipient responded to previous marketing campaigns and discounts can also help determine what, if any, future messages they should receive, through what channel(s), and whether the messages are likely to elicit a favorable response.

Hotel operators get excited about the ever-growing number of data sources, but, in the end, it is better to think of data in terms of “quality over quantity” rather than “the more the merrier.” Capturing and analyzing every last bit of data can be a recipe for disaster. At a certain point, more data can simply mean more noise and the exercise becomes one of diminishing returns. It is imperative hotel operators select data sources that will help with fast, accurate decision-making and avoid the temptation to capture and integrate every last piece of data available to them from every possible data source.